Muni Bond Ladder Etf

Build your bond ladder here.

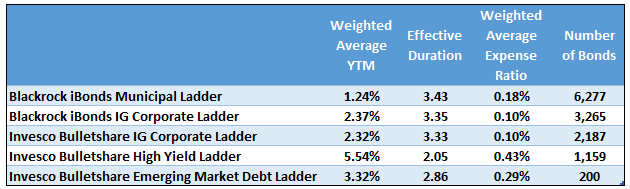

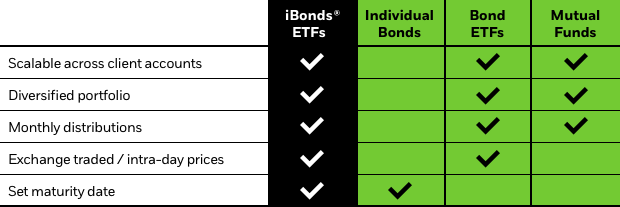

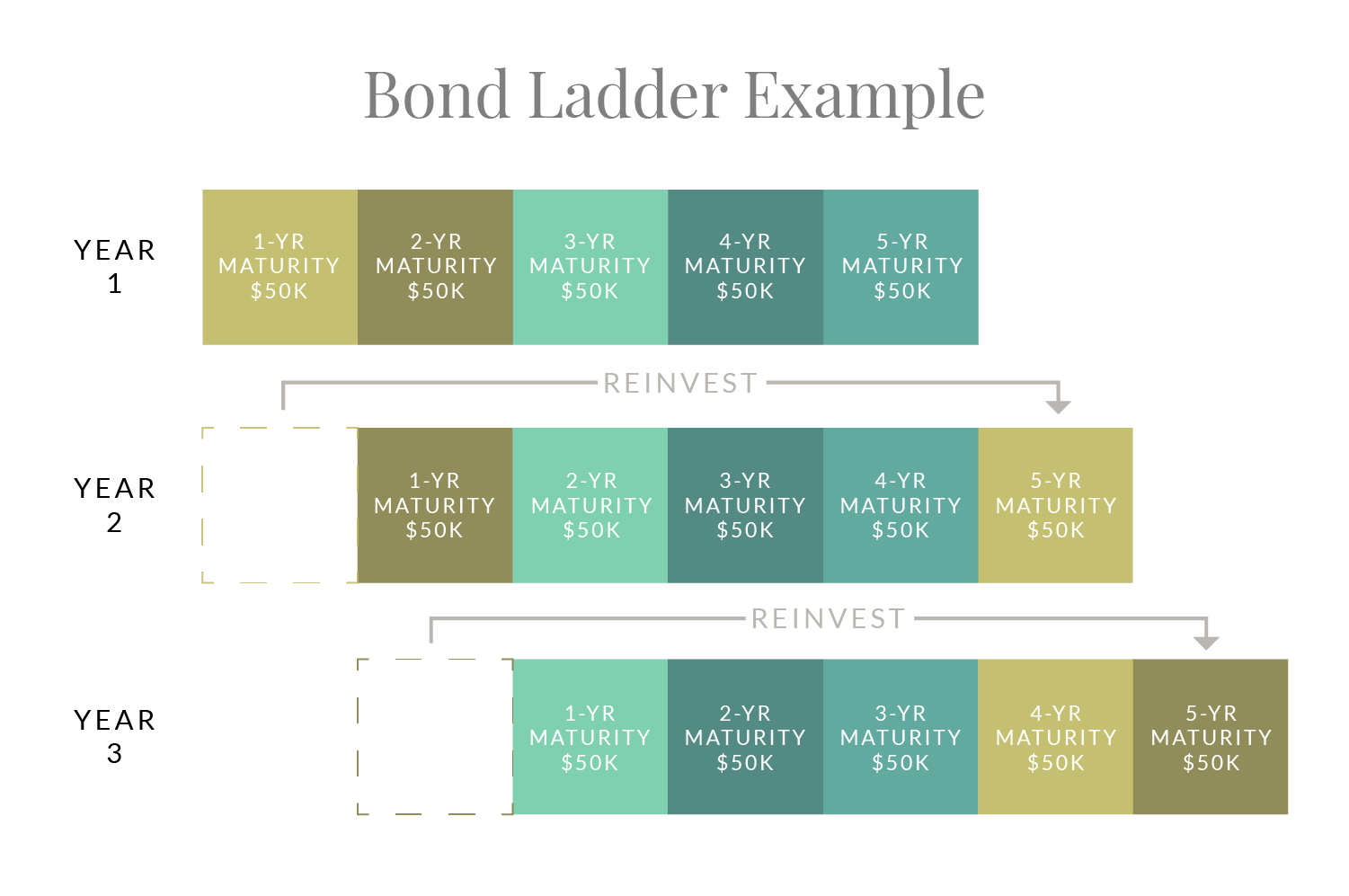

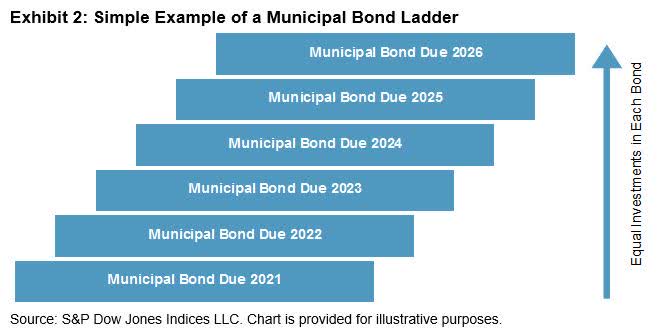

Muni bond ladder etf. 3 month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of different etf issuers with etfs that have exposure to municipal bonds. Ibonds etfs make it is easy to create scalable bond ladders with only a few etfs rather than trading numerous bonds. The bond ladder itself is fairly straightforward to create. A bond ladder protects against both rising and falling interest rates.

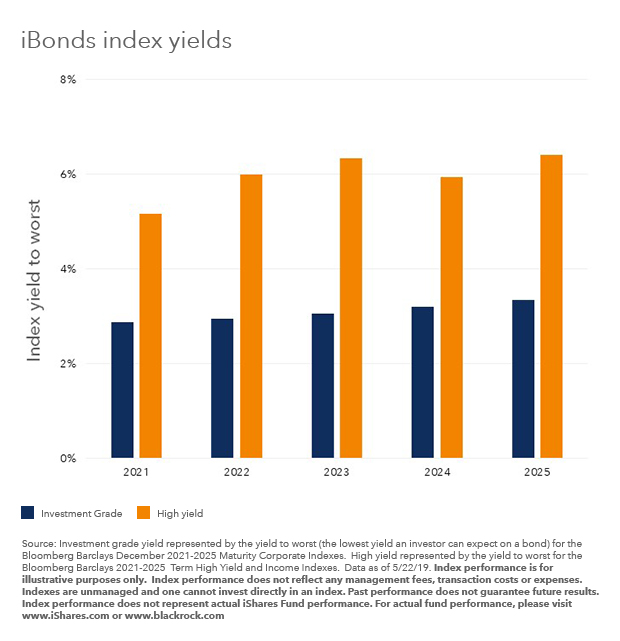

Build with ibonds and explore the benefits of bond etfs. For me it s still a comparison against individual bond ladders where if you re thinking of. Ibonds etfs offer diversified exposure to bonds that mature in the calendar year of the fund s name allowing you to target specific points on the yield curve. But etf bond ladders offer tremendous diversification inside of the maturity window you re looking at.

Etf issuers are ranked based on their aggregate 3 month fund flows of their etfs with exposure to municipal bonds. Ibmm which has a 0 18 expense ratio will help investors prolong their muni bond ladder strategy as the ishares ibonds. In the long term bond funds are usually a better option than individual muni bonds. This information is intended for us residents.

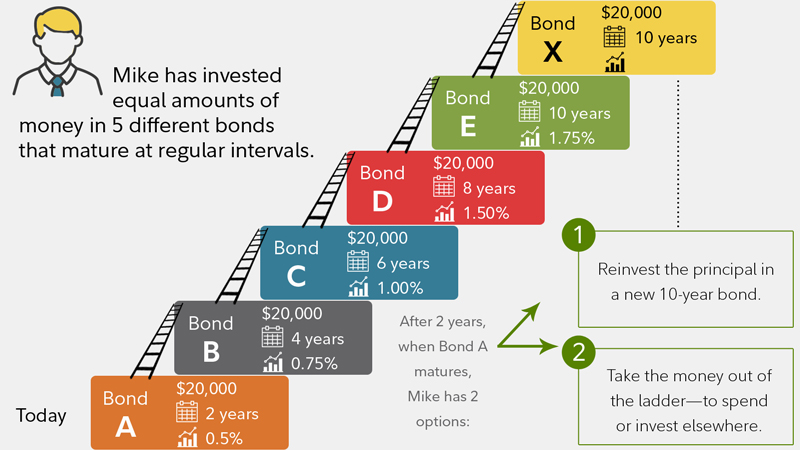

Pick points on the yield curve. Even in a low or rising interest rate environment bond ladders can help to balance the need for income while managing interest rate risk. Investing in a bond etf can provide. A traditional method to build a bond portfolio is to buy bonds with laddered maturities.

Municipal securities are subject to the risk that legislative or economic conditions could affect an issuer s ability to make payments of principal and or interest. This information is intended for us residents. All values are in u s. The overall length of time spacing between maturities and types of securities are primary considerations when building a bond ladder.

Build fully customized bond ladders with ishares etfs using the ibonds ladder tool.